|

Posted on

February 16, 2026

by

Hafez Panju

1 Bed, 1 Bath, 633sqft Priced at $458,800 Click for more … Enjoy the peace & tranquility this area has to offer. UniverCity at SFU is Vancouver’s premier lifestyle neighborhood. Welcome to this 1bed/1bath/633sqft home, located in Origin, one of SFU’s greenest buildings. You won’t be disappointed. Perfect for investors, first time buyers, students & everyone else in between. Features: freshly painted, open layout, spacious kitchen w/breakfast bar, SS appls, & quartz counters, hydronic heated floors, covered balcony & office nook. The bedrm has pass...

Posted on

February 11, 2026

by

Hafez Panju

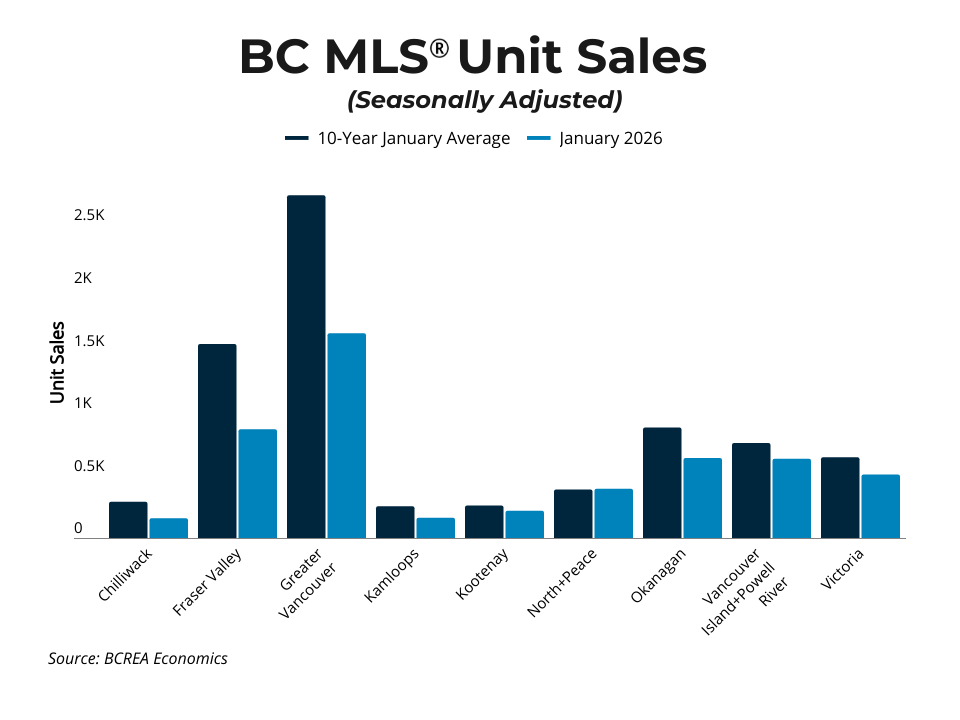

Vancouver, BC – February 11, 2026. The British Columbia Real Estate Association (BCREA) reports that 3,314 residential unit sales were recorded in Multiple Listing Service® (MLS®) Systems in January 2026, down 22.9 per cent from January 2025. The average MLS® residential price in BC in January 2026 was down 1.9 per cent at $924,239 compared to $942,384 in January 2025. Total MLS® residential sales dollar volume was $3.06 billion, down 24.4 per cent from the same time the previous year. BC MLS® unit sales were 30.97 per cent lower than the ten-year average for the month of January. “British Columbia’s...

Posted on

February 10, 2026

by

Hafez Panju

VANCOUVER, BC – February 3, 2026 – Last year’s market trends continued in January as home sales registered on the MLS® in Metro Vancouver* were 28.5 per cent lower than last year, setting the year off to a quieter start. The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 1,107 in January 2026, a 28.7 per cent decrease from the 1,552 sales recorded in January 2025. This was 30.9 per cent below the 10-year seasonal average (1,602). “On their own, the January sales appear alarming, but it’s important to put these figures in the context of the past few years. Last...

Posted on

January 12, 2026

by

Hafez Panju

VANCOUVER, B.C. – January 5, 2026 – Home sales registered in the Multiple Listing Service® (MLS®) in Metro Vancouver* finished the year down 10 per cent, marking the lowest annual sales total in over twenty years. The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 23,800 in 2025, a 10.4 per cent decrease from the 26,561 sales recorded in 2024, and a 9.3 per cent decrease from the 26,249 sales in 2023. Last year’s sales total was 24.7 per cent below the 10-year annual sales average (31,625). “This year was one for the history books,” said Andrew Lis, GVR’s chief...

Posted on

December 2, 2025

by

Hafez Panju

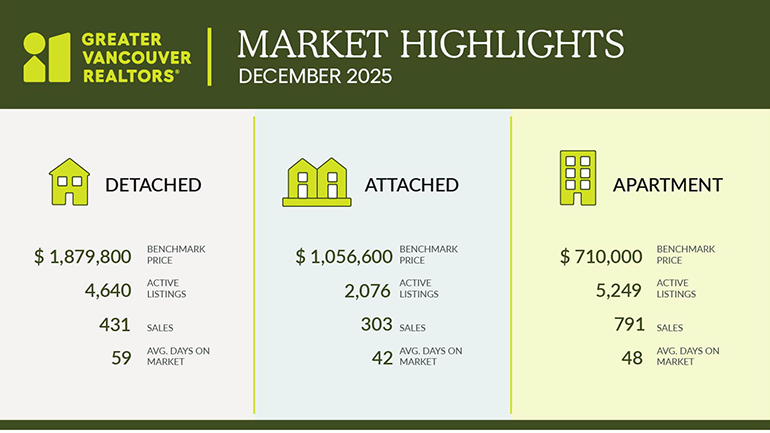

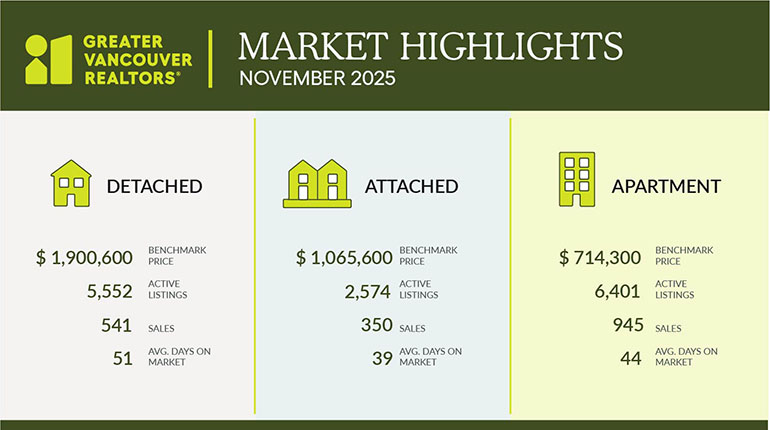

VANCOUVER, B.C. – December 2, 2025 – Metro Vancouver* home-sale trends observed in October continued in November, as sales registered on the MLS® remained lower than this time last year. The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 1,846 in November 2025, a 15.4 per cent decrease from the 2,181 sales recorded in November 2024. This was 20.6 per cent below the 10-year seasonal average (2,324). “As the year draws to a close, the data continues telling a story of a market with many buyers patiently waiting and sellers adjusting to market conditions not seen...

Posted on

November 4, 2025

by

Hafez Panju

VANCOUVER, B.C. – November 4, 2025 – Home sales registered on the MLS® in Metro Vancouver* were 14 per cent lower than last October, as the trend of slower sales and building inventory creates favourable conditions for those looking to buy in the fall market.The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 2,255 in October 2025, a 14.3 per cent decrease from the 2,632 sales recorded in October 2024. This was 14.5 per cent below the 10-year seasonal average (2,638).“October is typically the last month of the year where sales activity sees a seasonal uptick,...

Posted on

October 7, 2025

by

Hafez Panju

VANCOUVER, B.C. – October 2, 2025 – Another Bank of Canada rate cut and easing prices helped home sales registered on the MLS® in Metro Vancouver* edge higher relative to September last year. The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 1,875 in September 2025, a 1.2 per cent increase from the 1,852 sales recorded in September 2024. This was 20.1 per cent below the 10-year seasonal average (2,348). “With another cut to Bank of Canada’s policy rate behind us, and markets pricing in at least one more cut by the end of the year, Metro Vancouver homebuyers...

Posted on

September 19, 2025

by

Hafez Panju

The Bank of Canada today reduced its target for the overnight rate by 25 basis points to 2.5%, with the Bank Rate at 2.75% and the deposit rate at 2.45%.

After remaining resilient to sharply higher US tariffs and ongoing uncertainty, global economic growth is showing signs of slowing. In the United States, business investment has been strong but consumers are cautious and employment gains have slowed. US inflation has picked up in recent months as businesses appear to be passing on some tariff costs to consumer prices. Growth in the euro area has moderated as US tariffs affect trade. China’s...

Posted on

September 12, 2025

by

Hafez Panju

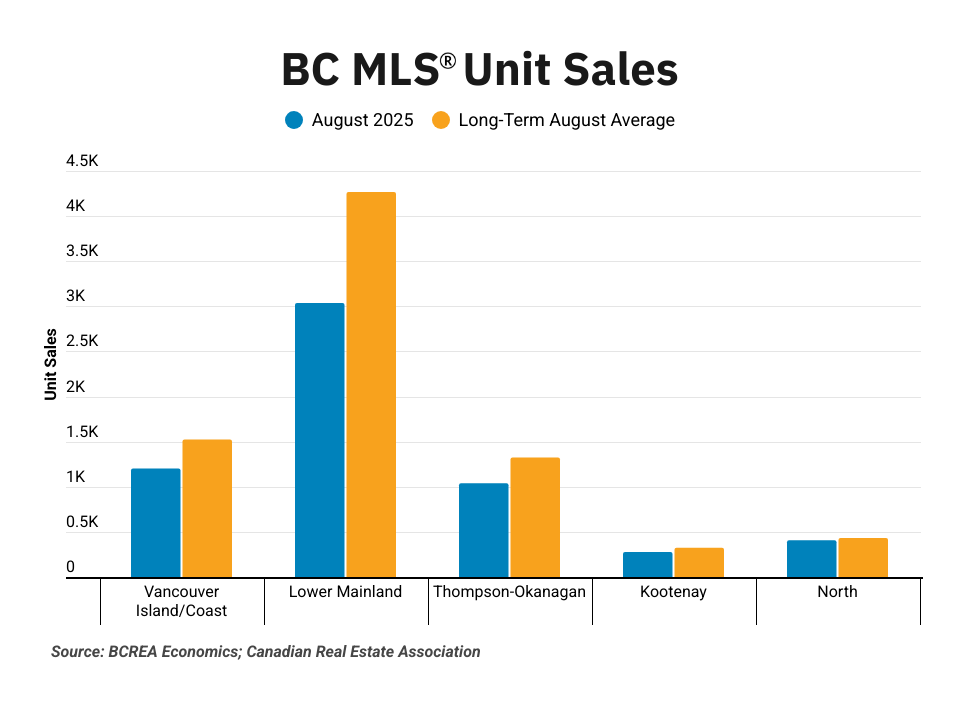

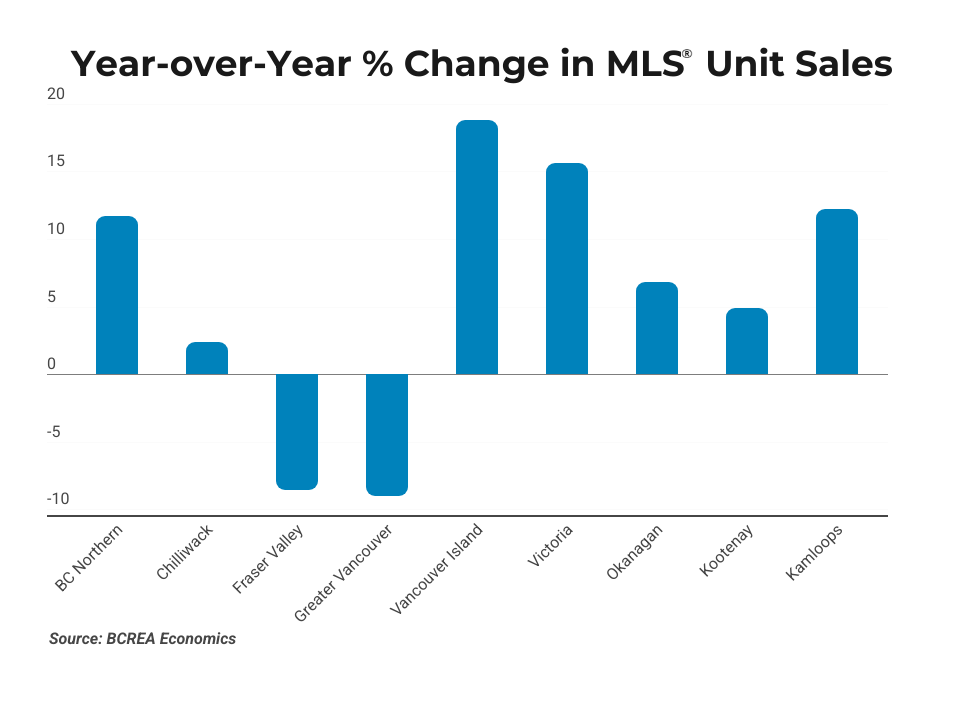

The British Columbia Real Estate Association (BCREA) reports that 5,961 residential unit sales were recorded in Multiple Listing Service® (MLS®) Systems in August 2025, up 0.5 per cent from August 2024. The average MLS® residential price in BC in August 2025 was down 1.4 per cent at $926,335 compared to $939,376 in August 2024.

The total sales dollar volume was $5.5 billion, down 0.9 per cent from the same time the previous year. BC MLS® unit sales were 24.2 per cent lower than the ten year August average.

“We continue to see significant regional disparity in the market, with...

Posted on

September 5, 2025

by

Hafez Panju

VANCOUVER, B.C. – September 3, 2025 – Easing prices brought more Metro Vancouver* homebuyers off the sidelines in August, with home sales on the MLS® up nearly three per cent from August last year.

The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 1,959 in August 2025, a 2.9 per cent increase from the 1,904 sales recorded in August 2024. This was 19.2 per cent below the 10-year seasonal average (2,424).

“The August sales figures add further confirmation that sales activity across Metro Vancouver appears to be recovering, albeit...

Posted on

August 15, 2025

by

Hafez Panju

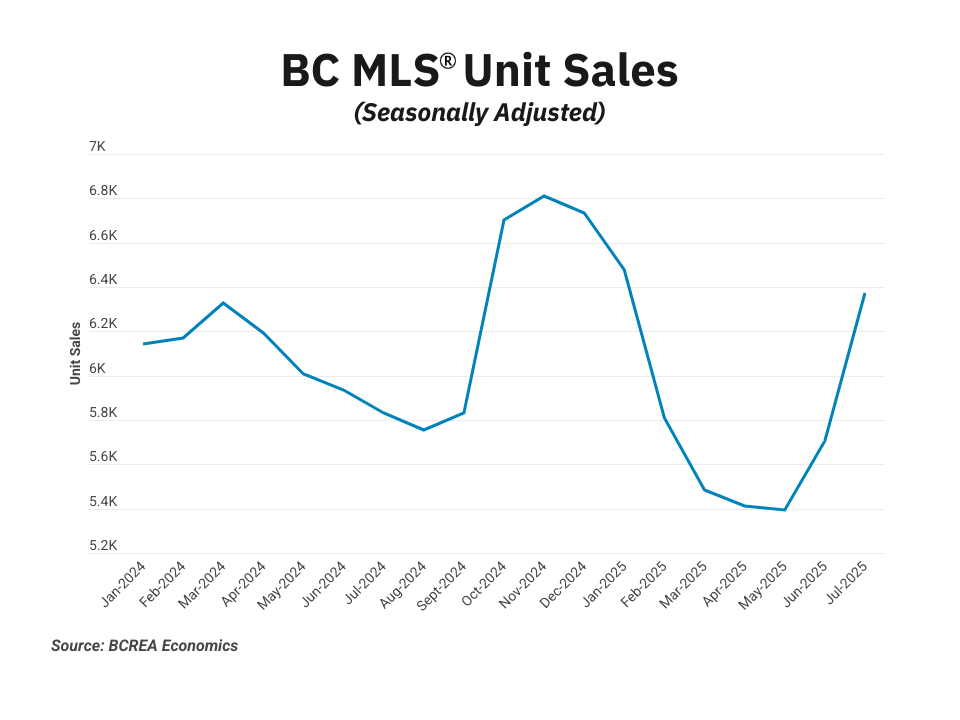

The British Columbia Real Estate Association (BCREA) reports that 7,056 residential unit sales were recorded in Multiple Listing Service® (MLS®) Systems in July 2025, up 2.2 per cent from July 2024. The average MLS® residential price in BC in July 2025 was down 2.1 per cent at $942,686 compared to $963,047 in July 2024.

The total sales dollar volume was $6.7 billion, virtually unchanged from the same time the previous year. BC MLS® unit sales were 16 per cent lower than the ten-year July average.

“Housing markets across BC continue to build momentum through the summer, with...

Posted on

August 11, 2025

by

Hafez Panju

Just Sold!

Bright and Spacious Layout

1 Bed + Den, 637sqft

Priced at $468,800

Click here for more...

Enjoy the peace & tranquility this area has to offer. Welcome to UniverCity at SFU, Vancouver’s premier lifestyle neighborhood. This 1 bed & den, 1 bath 637sqft home, located in Novo I; a concrete, rental and pet friendly building will not disappoint. Perfect for investors, first time buyers, students & everyone else in between. Features: an abundance of natural light, an open layout, granite counters, laminate floors, well sized covered balcony. The bedroom has plenty of closet...

Posted on

August 5, 2025

by

Hafez Panju

VANCOUVER, B.C. – August 5, 2025 – Home sales registered on the MLS® across Metro Vancouver* in July extended the early signs of recovery that emerged in June, now down just two per cent from July of last year.

The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 2,286 in July 2025, a two per cent decrease from the 2,333 sales recorded in July 2024. This was 13.9 per cent below the 10-year seasonal average (2,656).

“The June data showed early signs of sales activity in the region turning a corner, and these latest figures for July...

Posted on

July 21, 2025

by

Hafez Panju

Bright and Spacious Layout

1 Bed and Den, 637sqft

Priced at $468,800

Open: Sunday, July 27th from 2-4pm

Click here for more...

Enjoy the peace & tranquility this area has to offer. Welcome to UniverCity at SFU, Vancouver’s premier lifestyle neighborhood. This 1 bed & den, 1 bath 637sqft home, located in Novo I; a concrete, rental and pet friendly building will not disappoint. Perfect for investors, first time buyers, students & everyone else in between. Features: an abundance of natural light, an open layout, granite counters, laminate floors, well sized covered balcony. The bedroom...

Posted on

July 15, 2025

by

Hafez Panju

Vancouver, BC – July 14, 2025. The British Columbia Real Estate Association (BCREA) reports that 7,162 residential unit sales were recorded in Multiple Listing Service® (MLS®) Systems in June 2025, up 1.3 per cent from June 2024.

The average MLS® residential price in BC in June 2025 was down 4.2 per cent at $954,065 compared to $995,614 in June 2024. The total sales dollar volume was $6.8 billion, a 3 per cent decrease from the same time the previous year. BC MLS® unit sales were 23 per cent lower than the ten-year June average.

“Many regional housing markets across BC...

Posted on

July 2, 2025

by

Hafez Panju

VANCOUVER, BC – July 3, 2025 – After a turbulent first half of the year, home sales registered on the MLS® across Metro Vancouver* are showing emerging signs of a recovery, down ten per cent year-over-year – halving the decline seen last month.

The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 2,181 in June 2025, a 9.8 per cent decrease from the 2,418 sales recorded in June 2024. This was 25.8 per cent below the 10-year seasonal average (2,940).

“On a trended basis, signs are emerging that sales activity is rounding the corner...

Posted on

June 13, 2025

by

Hafez Panju

Vancouver, BC – June 12, 2025. The British Columbia Real Estate Association (BCREA) reports that 6,945 residential unit sales were recorded in Multiple Listing Service® (MLS®) Systems in May 2025, down 13.5 per cent from May 2024. The average MLS® residential price in BC in May 2025 was down 4.2 per cent at $959,058 compared to $1,001,341 in May 2024.

The total sales dollar volume was $6.7 billion, a 17.1 per cent decrease from the same time the previous year. BC MLS® unit sales were 26 per cent lower than the ten-year May average.

“All regions of BC have seen declining...

Posted on

June 3, 2025

by

Hafez Panju

VANCOUVER, BC – June 3, 2025 – May saw inventory levels across Metro Vancouver* reach another ten-year high, while home sales registered on the MLS® remained muted.

The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 2,228 in May 2025, an 18.5 per cent decrease from the 2,733 sales recorded in May 2024. This was 30.5 per cent below the 10-year seasonal average (3,206).

“While there are emerging signs that sales activity might be turning a corner, sales in May were below the ten-year seasonal average, which suggests that some buyers...

Posted on

June 2, 2025

by

Hafez Panju

Unique 2-in-1 Design

2 Bed, 2 Bath, 886sqft

Priced at $648,800

Click here for more...

WAIT! What? An apartment with a mortgage helper? This unique 2-in-1 is located in The Terraces— a concrete, rental & pet friendly building in SFU’s UniverCity, Vancouver’s premier life-style neighborhood. This 2bed/2bath/886sqft home w/covered balcony won't disappoint. Enjoy the entire unit or lock off the studio w/separate entry & have two units. Features: an open plan, spacious kitchen w/granite counters, SS apps & breakfast bar, laminate floors, spacious living & dining areas...

Posted on

May 2, 2025

by

Hafez Panju

Spring market brings abundance of opportunity for buyers The slowdown in home sales registered on the Multiple Listing Service® (MLS®) in Metro Vancouver that began early this year continued in April, with sales down nearly 24 per cent year-over-year. The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 2,163 in April 2025, a 23.6 per cent decrease from the 2,831 sales recorded in April 2024. This was 28.2 per cent below the 10-year seasonal average (3,014). “From a historical perspective, the slower sales we’re now seeing stand out as unusual,...

|

| | |