Statistics released today by the Canadian Real Estate Association (CREA) show national home sales and new listings were both down between April and May 2021.

Summary:

- National home sales declined by 7.4% on a month-over-month basis in May.

- Actual (not seasonally adjusted) activity was up 103.6% year-over-year.

- The number of newly listed properties fell back by 6.4% from April to May.

- The MLS® Home Price Index (MLS® HPI) rose 1% month-over-month and was up 24.4% year-over-year.

- The actual (not seasonally adjusted) national average sale price posted a 38.4% year-over-year gain in May.

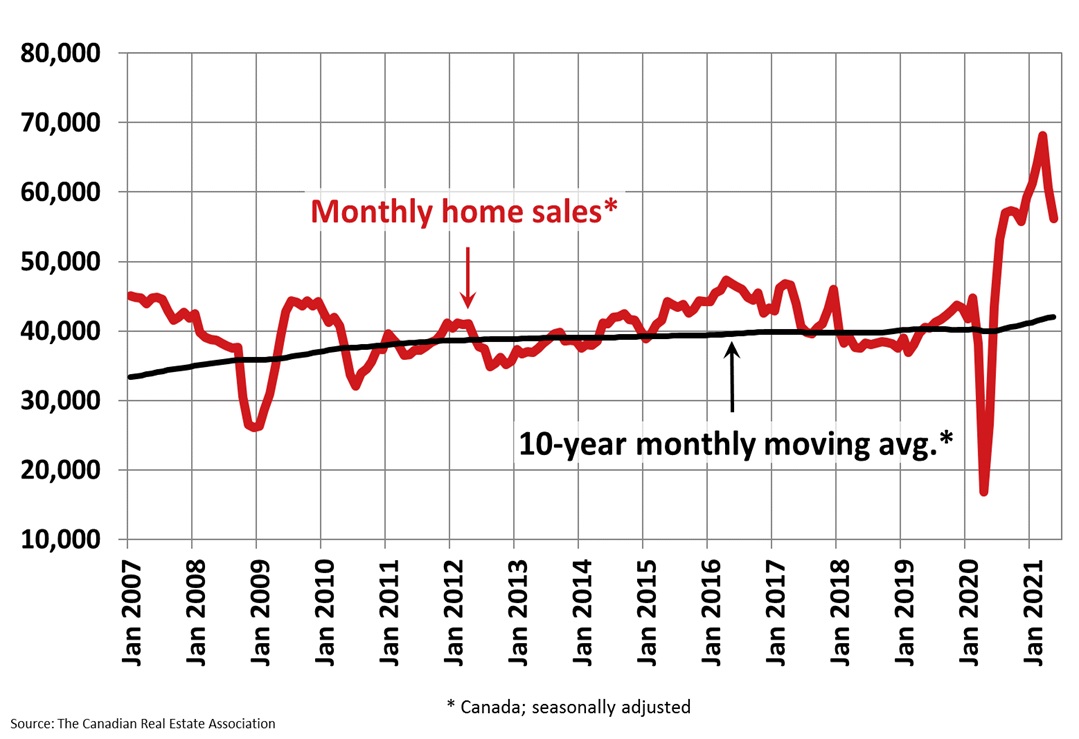

Home sales recorded over Canadian MLS® Systems fell by 7.4% month-over month in May 2021, building on the 11% decline recorded in April. Activity nonetheless remains historically high, but in contrast to March’s all-time record it is now running closer to levels seen in the second half of 2020.

Month-over-month declines in sales activity were observed in close to 80% of all local markets. It was a mixed bag of results, with a slowdown in sales observed in most large markets across Canada.

With May 2021 activity setting a record for the month, and May 2020 sales marking the worst May since the late 1990s, the actual (not seasonally adjusted) number of transactions this year represented a 103.6% increase on a year-over-year basis.

“While housing markets across Canada remain very active, we now have two months of moderating activity in the books, and that goes for demand, supply and prices,” stated Cliff Stevenson, Chair of CREA. “More and more, there is anecdotal evidence of offer fatigue and frustration among buyers, and the urgency to lock down a place to ride out COVID would also be expected to fade at this point given where we are with the pandemic. As always, your best bet is to consult with your local REALTOR® for the best information and guidance about buying or selling a home in this rapidly changing market,” continued Stevenson.

“With the synchronous cooling off of demand, supply and prices in recent months, one could draw comparisons to last year’s initial lockdowns, but this year feels different,” said Shaun Cathcart, CREA’s Senior Economist. “Of course, the main difference this year is that the slowdown in the market was coincident not just with record COVID cases and fresh lockdowns but with the take up in the vaccination rate, so maybe we all finally have something else to think about other than housing and being stuck at home all the time. Going forward there is still a good probability of increased churn in resale markets as we get more certainty around our post-COVID lives and people move around more than they would have in a non-COVID world. But for now at least, with the light at the end of the tunnel so close, it feels like housing may take a back seat to us all starting to get our lives back to normal this summer.”

The number of newly listed homes declined by 6.4% in May compared to April. At a time where so many markets are struggling with historically low inventory, sales activity depends on a steady stream of new listings each month. As such, the concurrent gains in new supply and sales in March followed by synchronous declines in April and May suggest the slowdown in sales may not only be a demand story. New listings were down about 70% of all local markets in May.

The national sales-to-new listings ratio was 75.4% in May 2021, down slightly from 76.2% posted in April. The long-term average for the national sales-to-new listings ratio is 54.6%, so it remains historically high; although, it has been moderating since peaking at 90.7% back in January.

Based on a comparison of sales-to-new listings ratio with long-term averages, only about a quarter of all local markets were in balanced market territory in May, measured as being within one standard deviation of their longterm average. The other three-quarters of markets were above long-term norms, in many cases well above.

The number of months of inventory is another important measure of the balance between sales and the supply of listings. It represents how long it would take to liquidate current inventories at the current rate of sales activity.

There were 2.1 months of inventory on a national basis at the end of May 2021, up from a record-low 1.7 months in March but still well below the long-term average for this measure of over 5 months.

The Aggregate Composite MLS® Home Price Index (MLS® HPI) rose 1% month-over-month in May 2021 – a noticeable deceleration. Most of the recent deceleration in month-over-month price growth has come from the single-family space compared to the more affordable townhome and apartment segments.

The non-seasonally adjusted Aggregate Composite MLS® HPI was up 24.4% on a year-over-year basis in May. Based on data back to 2005, this was another record yearover-year increase; although, it is not likely to go much higher at this point.

While the largest year-over-year gains continue to be posted across Ontario, this is also where month-over-month price growth has been slowing the most. Meanwhile, price growth has continued to accelerate in some other parts of the country, thus serving to reduce the year-over-year growth disparity between Ontario and other provinces.

The MLS® HPI provides the best way to gauge price trends because averages are strongly distorted by changes in the mix of sales activity from one month to the next.

The actual (not seasonally adjusted) national average home price was a little over $688,000 in May 2021, up 38.4% from the same month last year. That said, it is important to remember that the national average price dropped last April and May during the initial lockdowns as the higher-end of every market was effectively shut down. That serves to stretch these year-over-year comparisons over and above what is actually happening to prices.

The national average price is also heavily influenced by sales in Greater Vancouver and the GTA, two of Canada’s most active and expensive housing markets. Excluding these two markets from calculations cuts close to $140,000 from the national average price.

Provided by: CREA