Statistics released today by the Canadian Real Estate Association (CREA) show national home sales were up between January and February 2020.

Highlights:

- National home sales climbed 5.9% on a month-over-month (m-o-m) basis in February.

- Actual (not seasonally adjusted) activity was up 26.9% year-over-year (y-o-y).

- The number of newly listed properties jumped 7.3% m-o-m.

- The MLS® Home Price Index (HPI) advanced by 0.7% m-o-m and 5.9% y-o-y.

- The actual (not seasonally adjusted) national average sale price climbed 15.2% y-o-y.

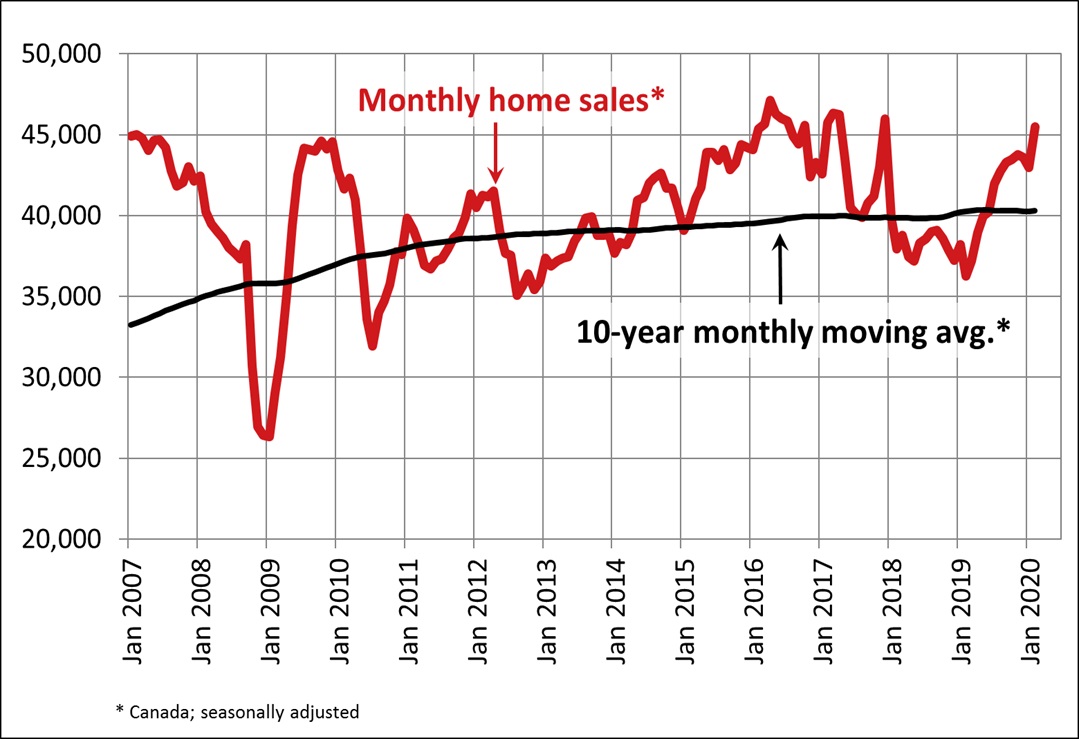

Home sales recorded over Canadian MLS® Systems rose by 5.9% in February 2020, marking one of the larger m-o-m gains of the past decade.

With transactions up in about 60% of all local markets in February, the big national increase was largely the result of a 15% jump in activity in the Greater Toronto Area (GTA). Many other Central and Southern Ontario markets also posted sizeable sales gains between January and February.

Actual (not seasonally adjusted) sales activity stood 26.9% above February 2019, although sales were quite weak a year ago. February 2019 marked a decade-low for the month, so a good part of the big y-o-y gain reflects low levels of activity recorded at the time. February 2020 also benefited from an additional day due to the leap year.

Transactions surpassed year-ago levels in about 80% of all local markets, including all large urban markets.

“Home prices are accelerating in markets where listings are in increasingly short supply, specifically in Ontario, Quebec and the Maritimes which together account for about two-thirds of national sales activity,” said Jason Stephen, president of CREA. “Meanwhile, ample supply across the Prairies and in Newfoundland and Labrador means increased competition among sellers. Whether you are looking to buy or sell, or both, all real estate is local, and nobody knows that better than a professional REALTOR®, your best source for information and guidance when negotiating the sale or purchase of a home,” said Stephen.

“Following a quieter than normal December/January period, February saw a burst of new listings in some of Canada’s most supply-starved markets, so it was not a surprise that sales were up alongside that increase in new supply,” said Shaun Cathcart, CREA’s Senior Economist. “There is some question about how much pent-up demand remains in parts of the country where listings have been low for some time now. That said, it will take more than one month of increased new listings to even start to turn some of these markets towards some semblance of balance. In the meantime, expect competition among buyers for available listings to continue to drive prices higher.”

The number of newly listed homes jumped 7.3% in February compared to January, more than erasing the declines of late last year. New supply gains were posted in a number of large markets, including the Fraser Valley, Calgary, Edmonton, the GTA, Hamilton-Burlington, Kitchener-Waterloo, Windsor-Essex, Ottawa and Montreal.

With new listings rising by slightly more than sales in February, the national sales-to-new listings ratio fell back to 64% compared to 64.9% posted in January. That said, the bigger picture is that this measure of market balance has been significantly above its long-term average of 53.8% for the last five months. Barring an unforeseen change in these recent trends, home prices appear poised to post further growth in 2020

Considering the degree and duration to which market balance readings are above or below their long-term averages is the best way of gauging whether local housing market conditions favour buyers or sellers. Market balance measures that are within one standard deviation of their long-term average are generally consistent with balanced market conditions.

Based on a comparison of the sales-to-new listings ratio with the long-term average, about 60% of all local markets were in balanced market territory in February 2020. Apart from a few areas of Alberta and Saskatchewan, the remainder were all favouring sellers.

The number of months of inventory is another important measure of the balance between sales and the supply of listings. It represents how long it would take to liquidate current inventories at the current rate of sales activity.

There were 4.1 months of inventory on a national basis at the end of February 2020 – the lowest level since the summer of 2007. This measure of market balance is now more than a full month below its long-term average of 5.2 months, suggesting sales negotiations are becoming increasingly tilted in favour of sellers.

National measures of market balance continue to mask significant and increasing regional variations. The number of months of inventory has swollen far beyond long-term averages in the Prairie provinces

and Newfoundland & Labrador, giving homebuyers ample choice in these regions. By contrast, the measure is running well below long-term averages in Ontario, Quebec and the Maritime provinces,

resulting in increased competition among buyers for listings and providing fertile ground for price gains. The measure remains in balanced territory in British Columbia.

The Aggregate Composite MLS® Home Price Index (MLS® HPI) rose 0.7% in February 2020 compared to January, marking its ninth consecutive monthly gain.

The MLS® HPI was up in February 2020 compared to the previous month in 15 of the 19 markets tracked by the index. As of this release, Winnipeg is in the MLS® HPI.

Looking at the big Prairie markets, home price trends have ticked downwards in Calgary and Edmonton to start 2020 but have generally been stable since the beginning of last year. Prices in Saskatoon have also been stable over the last year, while those in Regina have continued to trend lower. Prices in Winnipeg have been on a slow upward trend since the beginning of 2019.

Meanwhile, the recovery in home prices remains in full swing in British Columbia and in Ontario’s Greater Golden Horseshoe (GGH) region. Further east, price growth in Ottawa, Montreal and Moncton continues as it has for some time now, with Ottawa and Montreal prices accelerating to start 2020.

Comparing home prices to year-ago levels yields considerable variations across the country, although for the most part trends are still regionally split along east/west lines, with rising gains from Ontario east, and a mixed bag of smaller gains and declines in B.C. and the Prairies.

The actual (not seasonally adjusted) Aggregate Composite MLS® HPI rose 5.9% y-o-y, the biggest year-over-year gain since February 2018.

Prices are now back in positive y-o-y territory in both Greater Vancouver (+0.3%) and the Fraser Valley (+1.4%). Elsewhere in British Columbia, home prices logged y-o-y increases in the Okanagan Valley (+3.9%), Victoria (+4.3%) and elsewhere on Vancouver Island (+3.2%).

Calgary and Edmonton continued to post small y-o-y price declines, while the y-o-y gap was -5.4% in Regina. Prices in Saskatoon (+1.1%) and Winnipeg (+1.6%) both posted a small y-o-y increases in February.

In Ontario, home price growth has re-accelerated across the GGH, with a number of markets posting double-digit growth as of February. Meanwhile, price gains in recent years have continued uninterrupted in Ottawa (+14.7%), Montreal (+10.4%) and Moncton (+7.5%).

All benchmark home categories tracked by the index accelerated further into positive territory on a y-o-y basis, with similar sized gains among the different property types.

Two-storey single family homes posted the biggest y-o-y increase (+6.2%) followed closely by prices for apartment units (+6%), one-storey single-family homes (+5.4%) and townhouse/row units (+5.1%).

The MLS® HPI provides the best way to gauge price trends because averages are strongly distorted by changes in the mix of sales activity from one month to the next.

The actual (not seasonally adjusted) national average price for homes sold in February 2020 was around $540,000, up 15.2% from the same month the previous year.

The national average price is heavily influenced by sales in the GVA and GTA, two of Canada’s most active and expensive housing markets. Excluding these two markets from calculations cuts close to $130,000 from the national average price, trimming it to around $410,000.

Provided by: CREA