|

Posted on

June 24, 2019

by

Hafez Panju

Real estate prices in the region have risen by 316 per cent since 2000; New York just 103 per cent

We all know that real estate prices in Metro Vancouver have gone nuts over the past decade or so, but how does that growth compare with other North American cities?

Canadian housing blog Better Dwelling crunched the numbers and came up with a jaw-dropping graph that shows just how dramatically prices have risen in the region since 2000, as compared with cities such as New York, San Francisco, Los Angeles, Toronto and Montreal.

It found that Metro Vancouver home prices have risen a whopping...

Posted on

June 24, 2019

by

Hafez Panju

Rising atop Burnaby Mountain, this stylish one bedroom apartment residence at Veritas by Polygon is ideally situated for higher learning. Steps from a protected forest renowned for its natural beauty and spectacular views, Veritas enjoys immediate access to Simon Fraser University - Canada's top comprehensive university and a setting rich in culture and lifestyle opportunities. It is a very spacious one bedroom. The flex room is a bonus which can be used as study room. It is a great opportunity to own your dream home! Walk to SFU campus, bus loop, Nestors Market, and all the shops and restaurants....

Posted on

June 18, 2019

by

Hafez Panju

The British Columbia Real Estate Association (BCREA) released its 2019 Second Quarter Housing Forecast today.

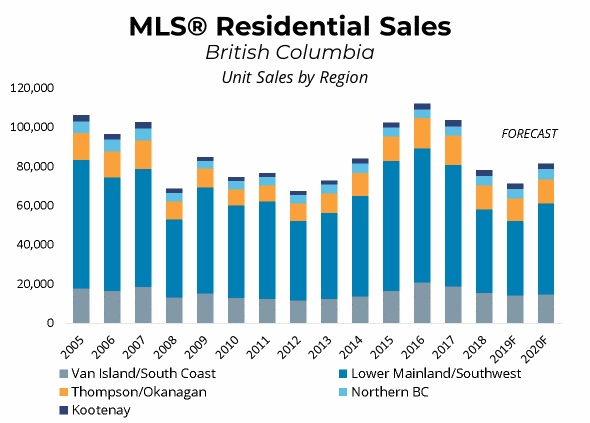

Multiple Listing Service® (MLS®) residential sales in the province are forecast to decline 9 per cent to 71,400 units this year, after recording 78,346 residential sales in 2018. MLS® residential sales are forecast to increase 14 per cent to 81,700 units in 2020. The 10-year average for MLS® residential sales in the province is 84,300 units.

“The shock to affordability from restrictive mortgage policies, especially the B20 stress test, will continue to limit housing...

Posted on

June 14, 2019

by

Hafez Panju

The British Columbia Real Estate Association (BCREA) reports that a total of 8,221 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in May, a decline of 7 per cent from the same month last year. The average MLS® residential price in the province was $707,829, a decline of 4.3 per cent from May 2018. Total sales dollar volume was $5.8 billion, an 11 per cent decline from the same month last year.

“BC home sales increased 9 per cent in May compared to April, on a seasonally adjusted basis,” said BCREA Chief Economist Cameron Muir. “However,...

Posted on

June 11, 2019

by

Hafez Panju

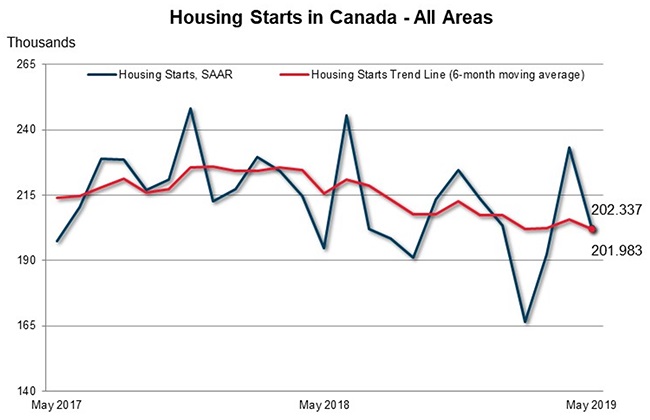

The trend in housing starts was 201,983 units in May 2019, compared to 205,717 units in April 2019, according to Canada Mortgage and Housing Corporation (CMHC). This trend measure is a six-month moving average of the monthly seasonally adjusted annual rates (SAAR) of housing starts.

"The national trend in housing starts decreased in May as a result of continuing decline in the trend for single starts as well as a decline in the trend of multi-unit starts that follows gains in this segment in recent months, in urban areas," said Bob Dugan, CMHC's chief economist. "The decrease in the trend of...

Posted on

June 10, 2019

by

Hafez Panju

Last week’s market reports from real estate boards including those in Vancouver and Toronto show that there is recovery underway with even the tough market conditions in Vancouver suggesting a bottoming-out.

This is unlikely to end calls for the mortgage stress tests to be altered or scrapped, says RBC Economics’ senior economist Robert Hogue, but it should “quiet down critics fearing a market collapse.”

In his latest assessment of the Canadian housing market, Hogue says the rebound for Toronto sales in May (resales up 19% year-over-year) says more about weakness a year ago...

Posted on

June 7, 2019

by

Hafez Panju

Fixed and variable loans have gotten cheaper because costs for lenders are down too

Spring is typically a busy time for home sales, so lenders are competing fiercely right now for new business — and that's adding up to record low rates for borrowers. (Ty Wright/Bloomberg)

House prices may be as high as ever in many parts of the country, but Canadian homebuyers are being offered some of the lowest mortgage rates seen in years as lenders battle to drum up new business.

Rates on a standard five-year fixed-rate mortgage have fallen to their lowest level in two years, according to...

Posted on

June 5, 2019

by

Hafez Panju

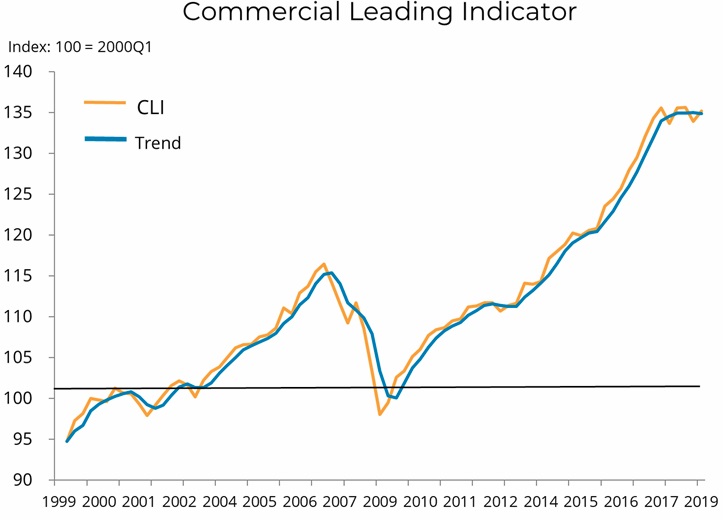

The BCREA Commercial Leading Indicator (CLI) rose by 1.3 points to 135.2 in the first quarter of 2019. Compared to this time one year ago, the index is 1.1 per cent higher.

“While economic activity remained tepid at the start of 2019, a rebound in financial markets pushed the CLI higher,” says BCREA Deputy Chief Economist Brendon Ogmundson. “That signals a lower risk environment, but a slowing economy may impact future commercial real estate activity.”

Following several years of robust growth, the BC economy continues to slow in the early part of 2019. The economic activity...

Posted on

June 4, 2019

by

Hafez Panju

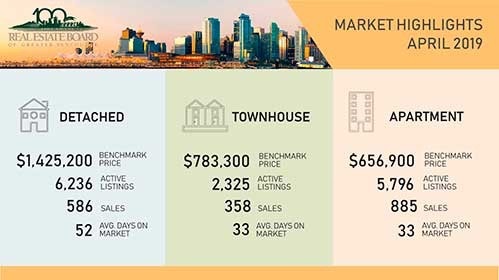

Monthly *Metro Vancouver1 home sales eclipsed 2,000 for the first time this year in May, although home buyer demand remains below historical averages.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales in the region totalled 2,638 in May 2019, a 6.9 per cent decrease from the 2,833 sales recorded in May 2018, and a 44.2 per cent increase from the 1,829 homes sold in April 2019.

Last month’s sales were 22.9 per cent below the 10-year May sales average and was the lowest total for the month since 2000.

“High home prices and mortgage q...

|

| | |