|

|

|

Posted on

March 28, 2019

by

Hafez Panju

Mortgage Rate Outlook

The once bright outlook for the Canadian economy darkened toward the end of 2018 amidst disruptions in Alberta oil production and a policy-induced slowdown in the Canadian housing market. This slowdown, along with global economic growth concerns, prompted a dramatic revision in market expectations for future Bank of Canada rate tightening. As a result, key benchmarks for bank borrowing costs plummeted, reversing course after a year of steady increases.

While those key benchmarks were falling, Canadian lenders delayed passing on savings to borrowers as the B20 mortgage stress...

Posted on

March 20, 2019

by

Hafez Panju

The 2019 federal budget includes a tantalizing pitch for prospective first-time home buyers — one that could see Canada's housing agency contribute up to 10 per cent of the purchase price of a home and bring down the mortgage load for borrowers.

The budget offers the program, known as the First Time Home Buyer Incentive, as a way to help with housing affordability. The government is earmarking $1.25 billion over three years for something it's calling a "shared equity mortgage."

Functionally, it's more like an almost interest-free loan — one where the repayment plan doesn't...

Posted on

March 19, 2019

by

Hafez Panju

On the eve of a federal election this fall, the Liberal government is looking to help more Canadians buy their first homes by picking up a portion of their mortgage costs and increasing the amount they can borrow from their retirement savings for a down payment.

Helping people enter the housing market has been a growing preoccupation for the Liberals ever since they were elected in 2015, with soaring real-estate prices in some of Canada's largest cities putting home ownership beyond the reach of many.

An estimated 1.6 million Canadian households are considered in ``core housing need,'' meaning people...

Posted on

March 15, 2019

by

Hafez Panju

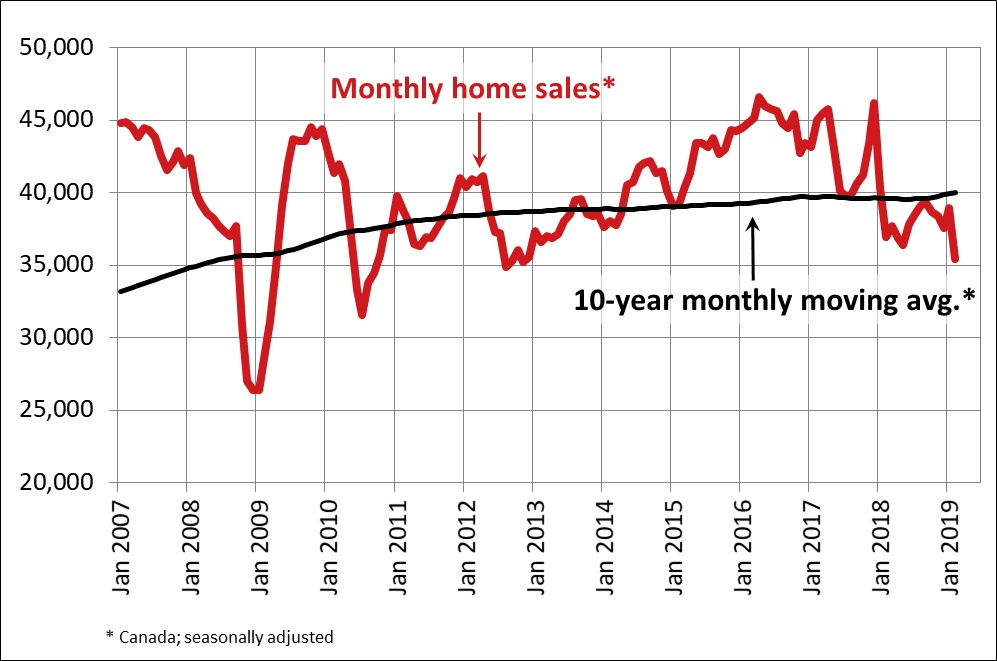

Statistics released today by the Canadian Real Estate Association (CREA) show national home sales dropped sharply from January to February 2019.

Highlights:

- National home sales plummeted 9.1% month-over-month (m-o-m) in February.

- Actual (not seasonally adjusted) activity was down 4.4% year-over-year (y-o-y).

- The number of newly listed homes fell 3.2% m-o-m.

- The MLS® Home Price Index (HPI) was virtually unchanged (-0.1% y-o-y).

- The national average sale price fell by 5.2% y-o-y.

Home sales via Canadian MLS® Systems plunged 9.1% m-o-m in February 2019 to the lowest level since November...

Posted on

March 13, 2019

by

Hafez Panju

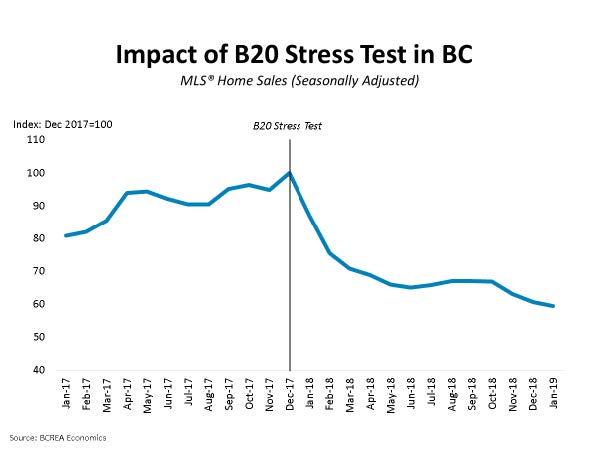

The British Columbia Real Estate Association (BCREA) reports that a total of 4,533 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in February, a decline of 27 per cent from the same month last year. The average MLS® residential price in the province was $678,625, a decline of 9.3 per cent from February 2018. Total sales dollar volume was $3.08 billion, a 33.8 per cent decline from the same month last year.

“Prospective homebuyers continue to be sidelined by the mortgage stress test,” said Brendon Ogmundson, BCREA Deputy Chief Economist....

Posted on

March 6, 2019

by

Hafez Panju

The Bank of Canada today maintained its target for the overnight rate at 1 ¾ per cent. The Bank Rate is correspondingly 2 per cent and the deposit rate is 1 ½ per cent.

Recent data suggest that the slowdown in the global economy has been more pronounced and widespread than the Bank had forecast in its January Monetary Policy Report (MPR). While the sources of moderation appear to be multiple, trade tensions and uncertainty are weighing heavily on confidence and economic activity. It is difficult to disentangle these confidence effects from other adverse factors, but it is clear...

Posted on

March 4, 2019

by

Hafez Panju

The Metro Vancouver* housing market saw increased supply from home sellers and below average demand from home buyers in February

The Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales in the region totalled 1,484 in February 2019, a 32.8 per cent decrease from the 2,207 sales recorded in February 2018, and a 34.5 per cent increase from the 1,103 homes sold in January 2019.

Last month’s sales were 42.5 per cent below the 10-year February sales average.

“For much of the past four years, we’ve been in a sellers’ market. Conditions have shifted...

|

| | |

|

|

|

The data relating to real estate on this website comes in part from the MLS® Reciprocity program of either the Greater Vancouver REALTORS® (GVR), the Fraser Valley Real Estate Board (FVREB) or the Chilliwack and District Real Estate Board (CADREB). Real estate listings held by participating real estate firms are marked with the MLS® logo and detailed information about the listing includes the name of the listing agent. This representation is based in whole or part on data generated by either the GVR, the FVREB or the CADREB which assumes no responsibility for its accuracy. The materials contained on this page may not be reproduced without the express written consent of either the GVR, the FVREB or the CADREB.