|

|

|

Posted on

December 18, 2018

by

Hafez Panju

A financial services institution is forecasting an ongoing slowdown in British Columbia's housing market, one day after the Canadian Real Estate Association predicted home sales will continue to dip in the province next year.

Central 1 Credit Union, which provides services to more than 300 credit unions across Canada, says in its housing forecast for 2018 to 2021 that B.C. experienced a "mild provincial housing recession" this year.

The report released Tuesday points to the federal government's mortgage stress test, higher interest rates and various provincial policy measures for the downturn and...

Posted on

December 17, 2018

by

Hafez Panju

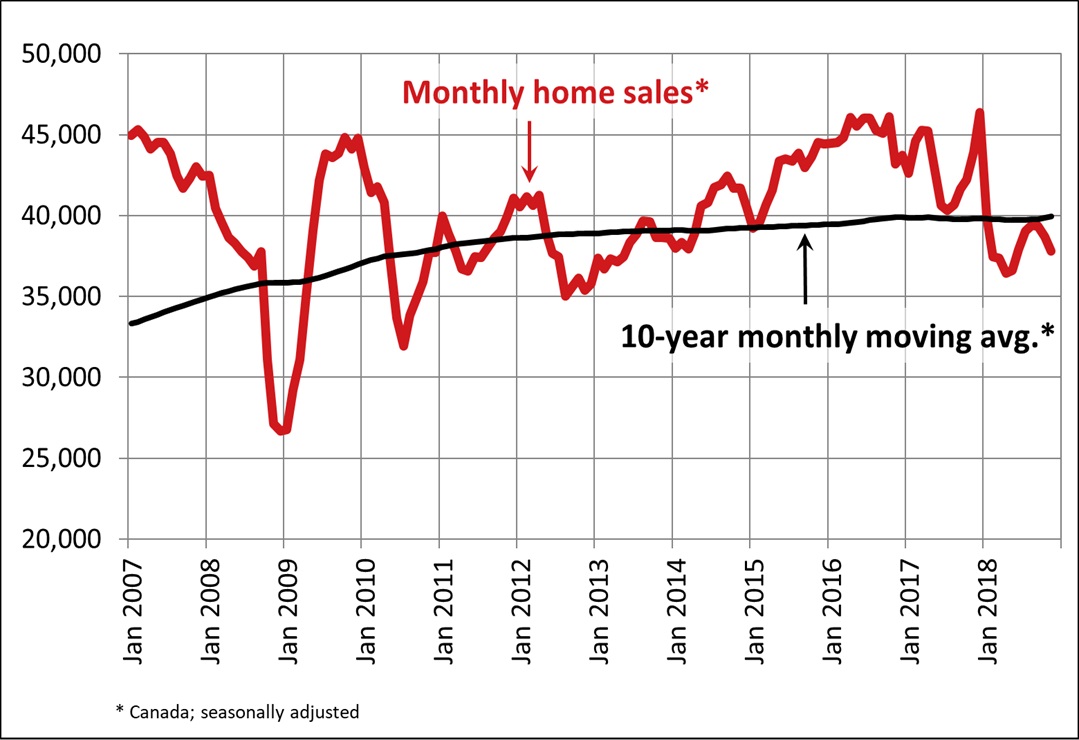

Statistics released today by the Canadian Real Estate Association (CREA) show national home sales posted another monthly decline in November 2018.

Highlights:

- National home sales fell 2.3% from October to November.

- Actual (not seasonally adjusted) activity was down by 12.6% from one year ago.

- The number of newly listed homes declined by 3.3% from October to November.

- The MLS® Home Price Index (HPI) was up 2% year-over-year (y-o-y) in November.

- The national average sale price retreated by 2.9% y-o-y in November.

Home sales via Canadian MLS® Systems fell by 2.3% in November 2018, adding to...

Posted on

December 14, 2018

by

Hafez Panju

The British Columbia Real Estate Association (BCREA) reports that a total of 5,179 residential unit sales were recorded by the Multiple Listing Service® (MLS®) across the province in November, down 33.1 per cent from the same month last year. The average MLS® residential price in BC was $718,903, a decline of 1.9 per cent from November 2017. Total sales dollar volume was $3.7 billion, a 34.3 per cent decline from November 2017.

“BC households continue to struggle with the sharp decline in purchasing power caused by the B20 mortgage stress test,” said Cameron Muir,...

Posted on

December 13, 2018

by

Hafez Panju

HIGHLIGHTS

• Oil prices prompt plunging bond yields

• Canadian economy slowing down

• How high can they go? Is the Bank of Canada already finished with rate increases?

Mortgage Rate Outlook

Midway through 2018, everything seemed to be pointing to sharply higher mortgage rates. The Canadian economy was soaring, the Bank of Canada and its counterpart in the US were resoundingly hawkish and bond yields were testing multi-year highs. However, declining oil prices, the stronger than expected impact of the B20 mortgage stress test and generally soft economic data in recent weeks have prompted...

Posted on

December 10, 2018

by

Hafez Panju

Amazing turnout for this year's 12th Annual Client Appreciation event. Private screening of The Grinch.

So grateful for all of your continued support.

Posted on

December 10, 2018

by

Hafez Panju

The natonal trend in housing starts increased in November, following four consecutve months of decline. While single-detached starts contnued to trend lower in November, this was more than ofset by a gain in the trend of mult-unit starts following several months of weakness.

The trend in housing starts was 210,038 units in November 2018, compared to 206,460 units in October 2018, according to Canada Mortgage and Housing Corporaton (CMHC). This trend measure is a six-month moving average of the monthly seasonally adjusted annual rates (SAAR) of housing starts.

Monthly Highlights

Vancouver...

Posted on

December 5, 2018

by

Hafez Panju

The Bank of Canada today maintained its target for the overnight rate at 1 ¾ per cent. The Bank Rate is correspondingly 2 per cent and the deposit rate is 1 ½ per cent.

The global economic expansion is moderating largely as expected, but signs are emerging that trade conflicts are weighing more heavily on global demand. Recent encouraging developments at the G20 meetings are a reminder that there are upside as well as downside risks around trade policy. Growth in major advanced economies has slowed, although activity in the United States remains above potential.

Oil prices have fallen...

Posted on

December 2, 2018

by

Hafez Panju

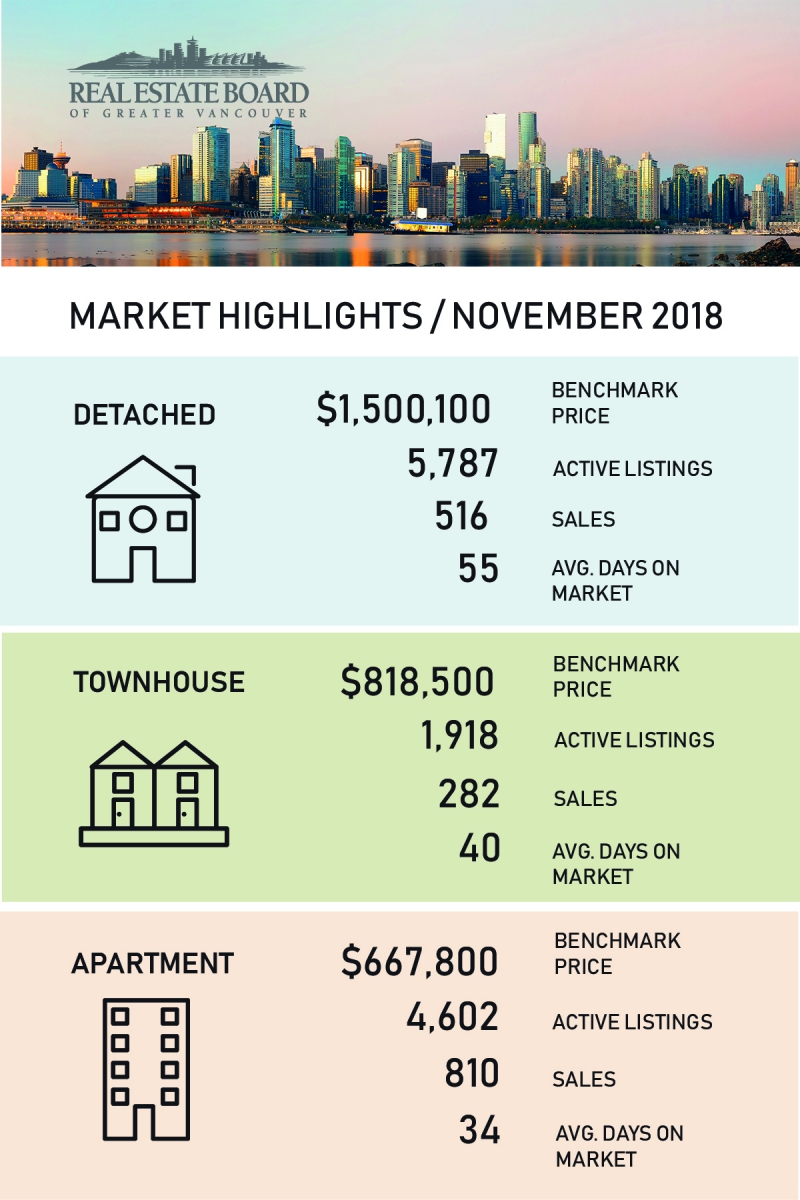

Home buyer demand remains below long-term historical averages in the Metro Vancouver* housing market.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales totalled 1,608 in the region in November 2018, a 42.5 per cent decrease from the 2,795 sales recorded in November 2017, and an 18.2 per cent decrease compared to October 2018 when 1,966 homes sold.

Last month’s sales were 34.7 per cent below the 10-year November sales average and was the lowest sales for the month since 2008.

“Home buyers have been taking a wait-and-see approach for most of 2018. This...

|

| | |

|

|

|

The data relating to real estate on this website comes in part from the MLS® Reciprocity program of either the Greater Vancouver REALTORS® (GVR), the Fraser Valley Real Estate Board (FVREB) or the Chilliwack and District Real Estate Board (CADREB). Real estate listings held by participating real estate firms are marked with the MLS® logo and detailed information about the listing includes the name of the listing agent. This representation is based in whole or part on data generated by either the GVR, the FVREB or the CADREB which assumes no responsibility for its accuracy. The materials contained on this page may not be reproduced without the express written consent of either the GVR, the FVREB or the CADREB.